Don't make these 3 mistakes that sabotage your retirement.

Most people know they need to save enough money for retirement, but they are often unsure of how much to save and what to do with the savings they have. Make sure your money is on track for retirement by making sure you aren’t making these three money mistakes.

- Procrastination

- Not Saving Enough

- Poor Investment Decisions

The good news is that with a little help you can get back on track and save enough for retirement even if you’ve made one of these mistakes.

1 . Procrastination.

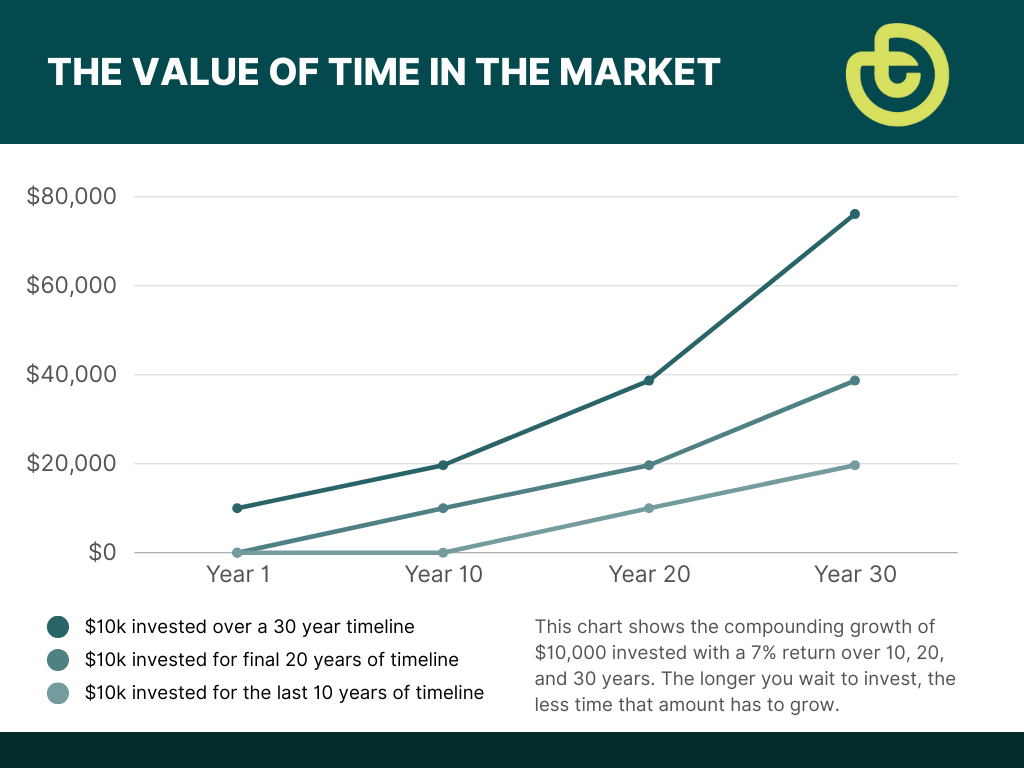

The Problem: Compounding interest is your best ally when saving for retirement. The difference between money that’s invested for 10, 20 or 30 years is significant. Let’s take a simple example. $10,000 invested in the S&P 500 for 10 years vs. 20 years vs 30 years. Assuming no other contributions and a return rate of 7% (historically, the S&P 500 has returned between 7% and 10% annually). The difference is stark.

10 years = $19,671.36

20 years = $38,696.84

30 years = $76,122.36

The Solution: Put your money to work today by investing it wisely. It is important to educate yourself on any investment before making an investment decision, or consult with a financial professional.

2. Not Saving Enough

The Problem: Many people don’t know whether they are saving enough for retirement. They don’t have many guideposts to help them know whether or not they are on track. Here is a general outline to see how you stack up with others depending on what decade of life you’re in.

While in your 20’s aim to have an emergency savings fund that can cover 3-6 months of your income.

As you move into your 30’s consider having about the equivalent of your salary in a retirement account.

Getting to your 40’s and you’ll be aiming to have 3 times your annual salary saved in a retirement account

In your 50’s your goal will be to have about 5 times your annual salary in a retirement account.

Once you hit your 60’s and beyond, hopefully you’ve saved between 8-10 times your annual salary amount.

Remember, saving for the long term is easier when compounding interest is working for you.

The Solution: Most people recommend saving between 10-15% of your annual salary each year into your retirement accounts. That will help keep you on track, even if your income increases as your career grows.

Ask a financial professional

This is Modal Title

Ask a financial advisor. No commitment or obligation. No cost necessary. OnTrajectory facilitates the conversation and keeps you in control.

3. Poor Investment Decisions

The Problem: It’s shocking to hear stories of how people have been saving money for retirement, but never put that money into any investment products. Things like stocks, bonds, mutual funds, ETF’s or any other investment product can be an option to grow your money depending on your personal investment style and preferences. Throughout your life, you’ll want to assess your investments based on your personal risk tolerance, whether your investments are meeting your goals and how soon you will need to use the money. You should also consider things like fees and whether your money is performing the way you expected. Emotional investment decisions can also have negative outcomes. Working with a licensed financial advisor to evaluate and help you make wise decisions, especially as you near retirement age, can help you structure your investments to meet your needs.

The Solution: If you’re going to manage your investments yourself, you’ll need to spend some time researching the investment options available to you. You’ll also want to spend some time thinking about your own risk tolerance, time horizon and investment goals. It’s important to consult a licensed financial professional when making investment decisions.

How can I get back on track if I've made a mistake?

If you aren’t where you need to be, or want some help making sure you are on the right track, consider the following steps.

- Increase your savings rate: Start by increasing the amount you contribute to your retirement plan. Even a small increase can make a significant difference over time. Consider maximizing your contributions to take advantage of any employer matching programs.

- Cut back on expenses: Review your budget and identify areas where you can reduce spending. By cutting back on non-essential expenses, you can free up more money to put towards your retirement savings.

- Work longer: Delaying retirement and continuing to work can provide you with additional income and allow your retirement savings to grow. Additionally, working longer can increase your Social Security benefits and reduce the number of years you’ll need to rely on your savings.

- Consider downsizing: If you own a large home, downsizing to a smaller, more affordable property can free up equity that can be used to boost your retirement savings.

- Invest wisely: Review your investment strategy and consider adjusting it to potentially earn higher returns. However, be mindful of the risks associated with more aggressive investment approaches.

- Seek professional advice: Consult with a financial advisor who can help you assess your situation and provide personalized guidance on how to make up for insufficient savings in your retirement plan.

Remember, it’s never too late to start taking steps towards improving your retirement savings. The key is to take action and make adjustments that align with your financial goals.

The information in this article should not be considered investment advice. Please consult with a licensed financial professional before making any investment decision. Remember no investments are guaranteed and past performance is not indicative of future results. See full disclosure below for more.