Start with these 7 steps to make sure you're saving enough for retirement

Step 1: Determine your retirement goals.

This is the fun part. Start by envisioning your desired lifestyle during retirement. Consider factors such as where you want to live, your desired activities, and any specific financial goals you have. Many people build a retirement vision board with pictures of the goals they want to achieve. Think about whether you want to stay in your current home or move to another location. Would you want to renovate your current home, own a second home or own no home and travel the globe for a while. Are you passionate about cooking or do you want a second act as an artist or writer? Let the dream start materializing, and then you can get to the hard part of making choices now to achieve the future you want later. Starting a conversation with an Advisor can help you figure out what steps you need to take to get there.

Step 2: Estimate your retirement expenses.

This is the part that, at least for some of us, is less fun. Calculate your expected expenses during retirement, including housing, healthcare, daily living costs, travel, and any other expenses unique to your situation. It’s important to be realistic and account for inflation. OnTrajectory’s Basic Cashflow tool can help you start this process, all it takes is answering 4 questions and you can get started. A simple way to get a ballpark number of how much you need to save to have your current income in retirement is to simply multiply your income by 25. If you are on track to have that amount in the bank when you retire, chances are, you’ll be close.

Step 3: Assess your current savings.

Take stock of your current retirement savings, including any employer-sponsored plans, individual retirement accounts (IRAs), and other investments. Consider the growth rate of your investments and the time remaining until retirement. When you look at the ways your money is invested, is it in the right growth vehicles and are the accounts properly structured to take advantage of different rules of account taxes.

Step 4: Calculate your retirement savings goal.

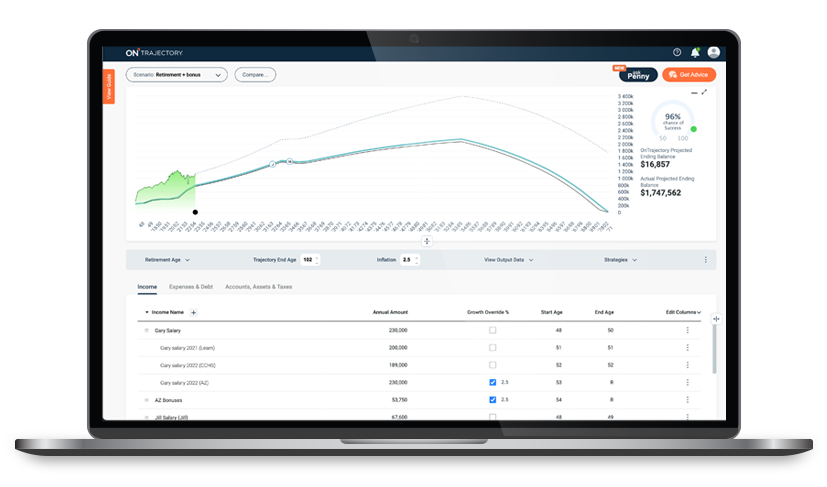

Use a retirement calculators or tool like OnTrajectory or consult with a financial advisor to determine how much you need to save to meet your retirement goals. Consider factors such as your desired retirement age, life expectancy, and expected investment returns. Wondering if you’re on track to retire, check out this post about 3 mistakes you don’t want to make in planning for retirement.

Step 5: Evaluate your savings rate.

Determine how much you’re currently saving towards retirement as a percentage of your income. Financial experts generally recommend saving at least 10-15% of your income for retirement, but the ideal savings rate depends on your specific circumstances. This rate can vary based on the age you started saving, how much you have saved and where that money is invested.

Step 6: Adjust your savings strategy.

If you find that you’re not saving enough, consider increasing your savings rate. Look for areas where you can cut expenses or increase your income to allocate more towards retirement savings. Automating your savings through automatic contributions can also help you stay on track.

Step 7: Monitor and review regularly.

Regularly review your retirement savings progress and make adjustments as needed. As you approach retirement, consider consulting with a financial advisor to ensure your savings strategy aligns with your goals. Reviewing your finances and even getting a second opinion can help you make sure you stay on track. Take Maria, an OnTrajectory user, for example. She asked an advisor to review her plan and found that by moving where her money was saved, she could save thousands as she neared retirement and began to.

Remember, everyone’s retirement needs are different, so it’s essential to personalize your savings plan based on your unique circumstances and goals.

Ready to get started? Ask an Advisor or start planning.