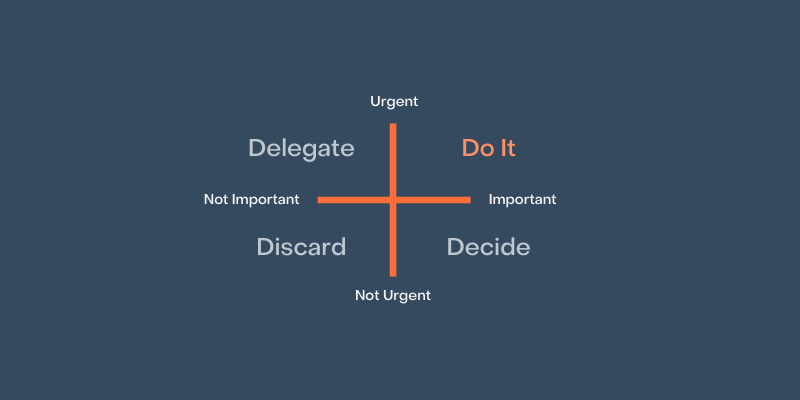

In the world of management, there’s an important decision-making tool called the Eisenhower Matrix. It’s a simple quadrant: The X axis evaluates how urgent a situation is, and the Y axis how important. So the top right quadrant shows tasks that are both urgent and important, and the bottom left shows tasks that are not urgent and not important. Guess which one we’re talking about today?

Managing your money is both urgent and important. But the goal of a financial plan is to take some of the urgency out of the equation. Markets and investment products can be complex. You have to manage your willingness to engage the complexity. Data is streaming constantly. It’s hard not to feel overwhelmed and incapable. But if you take the time to craft a long-term strategy, you can turn off your inner sirens and calm down.

I remember as an early 20-something visiting the trading floor in a regional investment bank and talking to many of the people working there. One guy said to me, “this is a great business, but you gotta love it. You can make a ton of money, but you have to pay attention all the time. I am checking international markets early in the morning and late at night. You gotta be on top of it.” That stuck with me because, while I like the idea of making a lot of money, I’m not sure I want making money to be the primary focus of my life. I imagine that’s true for most people, so we strike a balance. We have to decide a few things:

- How much risk we can tolerate

- How often we want to pay attention

- How we truly want to live and whether our money is serving that goal or hindering it.

Risk Tolerance

When deciding how to engage the markets, it helps to determine your comfort level with losing money. Bigger upside always represents a potential larger downside risk as well, and one of the foundational truths of behavioral finance–the study of how we make financial decisions–is that the pain of losing money is greater than the joy of making it. Figuring out how comfortable you are risking money is crucial.

Of course, different goals can dictate different risk strategies. Time horizons dictate different risk strategies too. For instance, If you have lots of time to recover from a possible loss, you may be willing to take more risks. This is true whether you decide to engage an advisor for help or whether you try your own hand at the market.

The rise of index funds and mutual funds have made it easier for the average consumer to minimize their risk by playing broader market trends rather than individual stocks. Either way you go, on your own or with an advisor, you need to know yourself and how you may handle ups and downs. If you’ve lived through a market downturn, you know how much it will bother you–or not.

Your risk tolerance will dictate your emotional state when looking at the market. So, how often should you look? That depends…

Rhythm of Attention

Most people make mistakes of emotion when it comes to investing. They don’t have a plan or strategy, so they only look when their feelings tell them to look. Trying to make investment decisions when you start from emotions almost always ends up in poor decisions. Panic usually does not result in the smartest, most effective choices.

Instead, make a point to review your goals on a schedule and gather some objective data points you rely on to make decisions. If you engage an advisor, you can develop those data points together. For instance, you may want to look at your portfolio monthly or even quarterly rather than daily or weekly. You may decide that rather than a schedule, you will re-evaluate your portfolio only if the market moves by 20%–up or down.

Whatever your rhythm, OnTrajectory can help you stay on top of your progress. In times of tumult, you can also compare your portfolio’s actual value to what you had expected. Make sure you pay attention to investments and expenses, most critically making sure you are sticking to the budget and investment plan you set for yourself. Sticking with your plan will give you the greatest chance to achieve your intended goals, assuming you have actually made some goals…

Money Focus

What do you want your money to do for you? Is there some number that, when achieved, will give you peace of mind? Do you want to accomplish specific things—say, buying a house or sending a child to college—that require a significant sum of money? Are you just trying to feel in control?

Too often people forget to figure out why they want to manage their money well. They just know they need to manage it and have this subtle feeling of dread that they aren’t doing as good of a job as they should. OnTrajectory helps you take a long view so you can see where your money is taking you, and then begin taking the steps to realize your dreams. So, what do you actually want? Is it a specific lump sum that will allow you to retire? Is it a set of monthly recurring income streams? Is it a specific amount you set aside for yourself, and then the ability to play with other money or support other people or charities? Making a plan starts with a baseline, a couple of goals and smart metrics to check your progress. Knowing your why helps you stay motivated.

Pick your canaries

Years ago, before the rise of modern mining technology, miners would bring canaries into coal mines to warn them of dangerous gasses; If the canaries died in their cages, it was time to evacuate. The birds were so effective at this job that the practice didn’t really end in Britain until 1986. The idea was based on the fact that since a canary is more sensitive to carbon monoxide, a deadly gas that is both odorless and colorless, it could function as an early warning device. Thankfully, today we can purchase carbon monoxide alarms at the hardware store and don’t have to sacrifice little birds.

Canaries and other “sentinel species” have been used throughout human history to warn of dangers that humans couldn’t sense. In the same way, when you are considering your finances you should find your canary and stick with it. You can’t watch everything, so you have to choose something. Maybe this is an individual (such as investment luminary Warren Buffett); maybe it’s a market number or percentage. Picking this sentinel wisely can help you figure out what changes, if any, you should make to your investment strategy. Often, this is a reason people choose to work with advisors. Advisors are trained and credentialed to manage assets and give credible advice. Financial coaches can help people get their finances in order so they can forge a path to building wealth.

Tracking your whole Trajectory

OnTrajectory makes it easy to visualize your path to prosperity, project your progress and track your actual results. What’s more, while you track the progress in your accounts, you also need to make sure you are staying on track relative to your budget—without judgment. So wherever you are on your financial journey, let’s work together to craft a plan and stick to it.